In the mid-1980s, Nick Leeson landed a job as a clerk with royal bank Coutts, followed by a string of positions with other banks, ending up at Barings, where he quickly made an impression and was promoted to the trading floor.

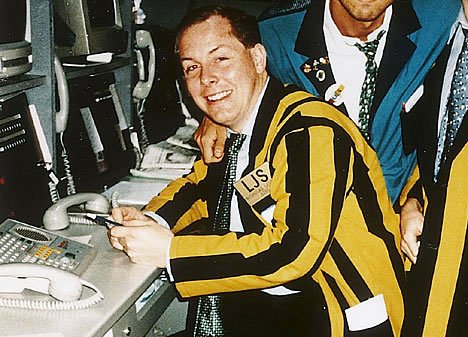

Before long, Nick was appointed the manager of a new operation in futures markets on the Singapore Monetary Exchange (SIMEX) and was soon making millions for Barings by betting on the future direction of the Nikkei Index. His bosses back in London, who viewed his large profits with glee, trusted the whizzkid. Leeson and his wife Lisa seemed to have everything: a salary of £50,000 with bonuses of up to £150,000, weekends in exotic places, a smart apartment, frequent parties and to top it all they seemed to be very much in love.

Barings wasn’t aware that it was exposed to any losses because Leeson claimed that he was executing purchase orders on behalf of a client. What the company did not realise, is that it was responsible for the 88888 error account where Leeson hid all of his losses. This account had been set up to cover up a mistake made by an inexperienced team member, which led to a loss of £20,000. Leeson now used this account to cover his own mounting losses.

As the losses grew, Leeson requested extra funds to continue trading, hoping to extricate himself from the mess by more deals. Over three months he bought more than 20,000 futures contracts worth about $180,000 each in a vain attempt to move the market. Some three quarters of the $1.3 billion he lost Barings resulted from these trades. When Barings executives discovered what had happened, they informed the Bank of England that Barings was effectively bust. In his wake Nick Leeson had wiped out the 233 year old Baring investment Bank, who proudly counted HM The Queen as a client. The $1.3 billion dollars of liabilities he had run up was more than the entire capital and reserves of the bank.

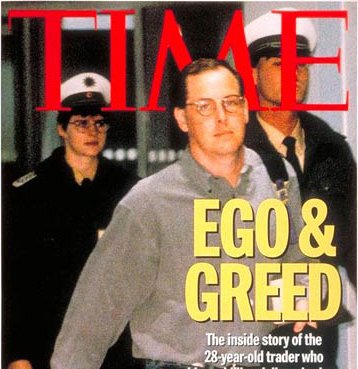

Eventually arrested in Frankfurt, Germany, Nick spent a few fraught months trying to escape extradition to Singapore. He failed and in December 1995 a court in Singapore sentenced him to six and a half years in prison. Lisa his wife got a job as an airhostess to be able to visit him regularly. At first, their marriage survived the strain of being apart, but she eventually divorced him. Within months, Leeson was diagnosed as suffering from cancer of the colon. His weight plummeted and most of his hair fell out from chemotherapy.

Finally released in 1999, and despite his return to the UK bringing a realisation that the high life had been swept away — he was effectively homeless and without a job — Nick enjoyed a fairly hedonistic first year seeing friends and family but also continuing his cancer treatment.

Nick Leeson has proved his resilience and has been able to capitalise on his experiences. He was paid a substantial fee for the newspaper serialisation of his book in The Mail. The story was then turned into a film, Rogue Trader, starring Ewan McGregor. During 2001 he undertook a Psychology degree and Nick now spends his time delivering conference and keynote talks to companies and undertaking after-dinner speaking based on his life experiences.

With a psychology degree and a second marriage to Irish beautician Leona Tormay, (with her own children Kersty and Alex) after trying for a baby they were delighted when, in 2004, Leona gave birth to a baby boy. Nick comments; “I’m of the mindset that cancer must not take you over and control your life. I do believe that the more positive you are, the greater your chance of survival.” his advice to others is never to bottle up stress as he himself did: “You need to talk and express yourself as I now do to Leona. With cancer as with other problems, it’s amazing how adaptable human beings are, and you will be able to cope provided you keep a strong frame of mind.”

In April 2005 Nick was appointed Commercial Manager of Galway United Football Club, rising to the position of General Manager in late November 2005. The same year Nick published his second book Back from the Brink, Coping with Stress co-written with psychologist Ivan Tyrell. July 2007 saw his appointed as CEO of the football club where he remained in this position until his resignation in February 2011.

Nick is currently CEO and owner of Bull and Bear Capital Limited